Auction houses price rare trading cards through a layered evaluation that starts with third-party grading, then factors in population scarcity, comparable sales data, and market timing. A card’s condition grade — scored on a 1 to 10 scale by services like PSA, BGS, or SGC — is the single biggest determinant of auction value. From there, auction specialists cross-reference population reports, recent sale prices for similar cards, and broader market demand to land on an estimate. The process is part science, part art, and understanding it can mean the difference between overpaying at auction and recognizing a genuine deal. Consider the Pikachu Illustrator card that sold on February 16, 2026 for $16.49 million through Goldin Auctions.

That price wasn’t arbitrary. It was the only known PSA 10 copy of a card with just 39 total ever produced — a 1998 Japanese contest prize with decades of provenance behind it. The combination of perfect grade, extreme scarcity, cultural significance, and two high-profile parties (Logan Paul selling to A.J. Scaramucci) created the conditions for a new Guinness World Record. This article breaks down every factor that feeds into auction house pricing, from grading costs and fee structures to market cycles and what comparable sales actually tell you.

Table of Contents

- What Do Auction Houses Evaluate When Pricing Rare Trading Cards?

- How Grading Costs and Population Affect Card Values

- Auction House Fee Structures and What Sellers Actually Keep

- What Drives Prices Beyond the Grade on the Slab

- Market Cycles and the Risk of Buying at the Wrong Time

- Record Sales and What They Reveal About Pricing Logic

- Where Card Auction Pricing Is Headed

- Conclusion

- Frequently Asked Questions

What Do Auction Houses Evaluate When Pricing Rare Trading Cards?

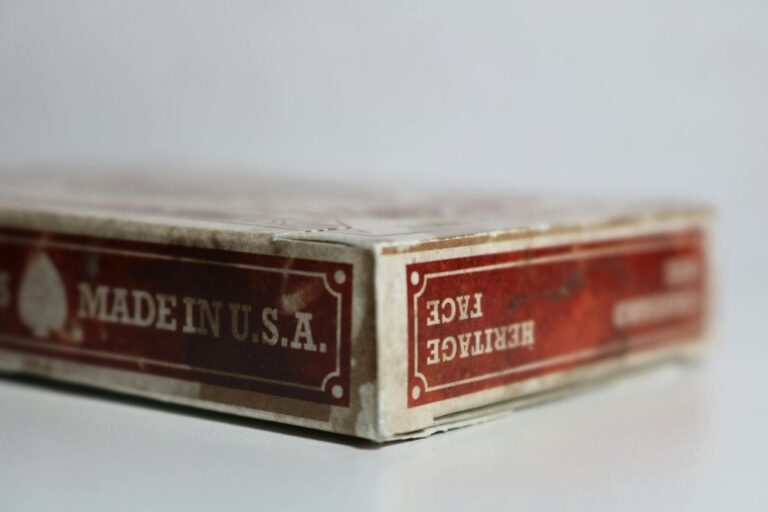

Auction houses begin with grading, and grading begins with four physical attributes: centering, corners, edges, and surface quality. PSA, BGS, and SGC each use a 1 to 10 scale, but a PSA 10 (Gem Mint) and a BGS 10 (Pristine) are not identical standards. PSA 10 is generally considered the market standard for most collectors and commands the strongest premiums, while BGS Pristine and the elusive BGS Black Label 10 carry their own niche appeal. A card graded PSA 9 might sell for a fraction of the same card at PSA 10 — the jump between those two grades at the top of the scale is where pricing gets exponential rather than linear. Beyond the grade itself, auction specialists pull up PSA population reports to see exactly how many copies of a given card exist at each grade level. If only three PSA 10 copies of a vintage card are known to exist, that scarcity directly inflates the estimate.

Scarcity isn’t just about original print runs, either. It accumulates from decades of handling damage, lost collections, and cards sitting ungraded in shoeboxes. A card printed in large quantities in 1999 might have very few surviving copies in top condition today, making those remaining high-grade examples genuinely rare. The third pillar is comparable sales data, often called “comps.” Auction houses look at what the same card — in the same grade, from the same set — has sold for recently. This is the most reliable pricing indicator because it reflects what actual buyers have been willing to pay under current market conditions, not what a price guide published six months ago suggests. PSA’s own Auction Prices Realized database is one of the primary tools used for this, alongside data from completed sales at Heritage, Goldin, and other major houses.

How Grading Costs and Population Affect Card Values

Grading isn’t free, and the costs have been climbing. PSA raised its grading prices in September 2025, bumping Value Bulk from $19.99 to $21.99 per card, Value from $24.99 to $27.99, and Value Plus from $39.99 to $44.99. Then in February 2026, another flat $5 increase hit across multiple tiers. These price hikes matter for collectors weighing whether to submit a card for grading at all — if the card’s expected value doesn’t comfortably exceed the grading fee plus shipping and insurance, the economics don’t work. PSA currently processes roughly 1.3 million cards per month, which gives you a sense of the volume flowing through the system and why turnaround times can stretch. However, there’s a nuance that trips up newer collectors. A high grade doesn’t automatically mean a high price.

If a modern card has 50,000 copies graded PSA 10, the population is so large that the grade barely moves the needle. Population reports cut both ways — they confirm scarcity for vintage cards, but they can also reveal that a “gem mint” modern card is anything but rare. Before submitting a card or bidding at auction, always check the population report. A PSA 10 of a card with a population of 47,000 is a fundamentally different asset than a PSA 10 with a population of 12. The practical warning here: don’t assume grading will increase your card’s value. For common modern cards, the grading fee might exceed the premium a graded copy commands over a raw one. Grading makes the most financial sense for vintage cards, low-population modern cards, and cards where the difference between a 9 and a 10 represents a significant dollar gap.

Auction House Fee Structures and What Sellers Actually Keep

Understanding fee structures is critical because the hammer price — what the winning bidder pays — is not what the seller receives. Heritage Auctions charges a 5% consignment fee to sellers and tacks on a 20% buyer’s premium (with a minimum of $14 per lot). That means a card that hammers at $1,000 costs the buyer $1,200, while the seller receives $950 before any additional fees. Goldin Auctions charges a 9% consignment fee to sellers, with a buyer’s premium that’s negotiable based on item value — higher-value consignments can secure lower premiums. Huggins and Scott sits at a 10% consignment fee. These differences add up fast on high-value lots. On a card that sells for $100,000, the Heritage seller keeps roughly $95,000, while a Goldin seller keeps about $91,000.

But the choice isn’t purely about fees. Heritage has the deepest historical auction archive and draws a massive base of traditional collectors. Goldin has carved out a strong position with modern sports and pop culture cards and tends to attract younger, higher-spending bidders for marquee lots. The right auction house depends on what you’re selling and who’s most likely to bid on it. Auction formats also matter. Some sales are absolute auctions with no reserve, meaning the card sells to the highest bidder regardless of price. Others use minimum bid formats where the card won’t sell below a set threshold. No-reserve auctions tend to generate more bidding activity and excitement, but they carry real risk if the market is soft or the lot doesn’t attract enough attention.

What Drives Prices Beyond the Grade on the Slab

A PSA 10 grade is necessary but not sufficient for record prices. Auction houses weigh several factors that exist outside the plastic slab. For sports cards, player performance and popularity are enormous — an active star athlete in the middle of a championship run commands premiums that a retired player doesn’t. Rookie status matters consistently: first-year cards almost always fetch the highest prices within a player’s card portfolio. And historical significance adds a layer that transcends stats. The 1914 Baltimore News Babe Ruth rookie, graded a modest SGC 3, sold for $4.03 million through Heritage Auctions in 2025. The grade is low by modern standards, but the card’s place in baseball history and its extreme rarity override condition concerns.

For Pokemon cards, the dynamics shift but the principles hold. The Pikachu Illustrator doesn’t have a batting average — its value comes from cultural significance, extreme scarcity (39 ever made), and its status as the most iconic card in the hobby. Similarly, first-edition Base Set Charizards carry a nostalgic weight that drives prices well beyond what a pure scarcity analysis would suggest. Auction houses factor in these intangibles alongside the hard data. The tradeoff collectors face is between buying the highest-grade copy they can afford versus buying a more historically significant card at a lower grade. A PSA 10 modern ultra-rare might look impressive, but a PSA 5 vintage card with deep historical roots may hold its value more reliably across market cycles. Auction house pricing reflects this — estimates on vintage cards tend to be more conservative because the floor is well-established, while modern card estimates can swing wildly with hype cycles.

Market Cycles and the Risk of Buying at the Wrong Time

The global collectible trading cards market is estimated at $5.92 billion in 2025 and is projected to reach $14.28 billion by 2034, representing a 10.3% compound annual growth rate. Those headline numbers sound bullish, but they mask significant volatility within the market. The recent cycle tells the story clearly: expansion from 2016 through 2021, a painful correction in 2022 and 2023, and what analysts are calling an accumulation phase from 2024 through 2026. During the correction, cards that sold for six figures at peak were reselling for a fraction of those prices, and auction houses adjusted their estimates downward accordingly. The warning for collectors is that auction house estimates are backward-looking by nature. They’re based on comparable sales data, which means they reflect where the market has been, not necessarily where it’s going.

During a rapid run-up, estimates lag behind actual sale prices, creating the illusion of bargains. During a correction, estimates can be sticky on the high side, leading to unsold lots and disappointed sellers. The most sophisticated collectors track not just final sale prices but also sell-through rates — the percentage of lots that actually find buyers — as a leading indicator of market health. High-grade, culturally iconic cards are best positioned to weather downturns. The Pikachu Illustrator and the Jordan-Bryant Dual Logoman aren’t going to zero regardless of market conditions. But mid-tier modern cards without the scarcity or cultural anchoring are far more vulnerable to price swings. Auction houses know this, which is why their estimates for blue-chip cards tend to be tighter and more reliable than estimates for cards in the speculative middle.

Record Sales and What They Reveal About Pricing Logic

The record sales of 2025 and 2026 illustrate how auction houses think about pricing at the extreme end. The $12.93 million Jordan-Bryant Dual Logoman — a 2007-08 Upper Deck Exquisite 1-of-1 graded PSA 6 — sold through Heritage Auctions and set the all-time public record for sports cards. A PSA 6 is a middling grade, but when only one copy of a card exists, the grade becomes secondary to uniqueness. Meanwhile, the $10 million Jordan-LeBron Dual Logoman from the same era sold privately in 2025, bypassing the auction process entirely.

Private sales are increasingly common for top-tier cards because both parties can avoid buyer’s premiums and consignment fees, though they sacrifice the price discovery that a competitive auction provides. These sales also show that auction houses function as much as marketing engines as pricing mechanisms. Heritage and Goldin invest heavily in cataloging, photography, provenance research, and media outreach for marquee lots. The $16.49 million Pikachu Illustrator sale generated international news coverage — CNN, sports outlets, and financial media all picked it up. That visibility is part of what sellers are paying for when they consign to a major house rather than listing on eBay.

Where Card Auction Pricing Is Headed

The accumulation phase of 2024 through 2026 suggests that smart money is positioning for the next expansion cycle. Auction houses are responding to shifting demand by expanding into Pokemon, Japanese cards, and other non-sports categories that were afterthoughts a decade ago. The fact that a Pokemon card now holds the all-time auction record across all trading card categories — not just within the Pokemon niche — signals a fundamental shift in how auction houses approach pricing for collectible cards broadly.

Looking ahead, expect grading costs to continue rising as PSA and its competitors invest in authentication technology and manage sustained submission volume. Those rising costs will create a natural floor that discourages grading of low-value cards, which over time should concentrate graded populations at the higher end of value and make population data even more useful as a pricing tool. For collectors, the takeaway is straightforward: understand the pricing inputs that auction houses use, and you can evaluate whether an estimate is reasonable before you ever raise a paddle.

Conclusion

Auction house pricing for rare trading cards rests on a foundation of third-party grading, population scarcity, comparable sales data, and market timing. The grade on the slab sets the baseline, population reports establish rarity, recent comps anchor the estimate, and broader market conditions determine whether that estimate is conservative or aggressive. Fee structures vary meaningfully between houses — Heritage at 5% seller commission with a 20% buyer’s premium, Goldin at 9% with negotiable premiums, Huggins and Scott at 10% — and choosing the right venue for a given card can materially affect the final outcome. For collectors looking to buy or sell at auction, the actionable steps are clear.

Always check population reports before bidding. Always calculate the true cost including buyer’s premiums. Study sell-through rates alongside hammer prices to gauge market strength. And recognize that the highest-profile auction results — the $16.49 million Pikachu Illustrator, the $12.93 million Jordan-Bryant Logoman — represent the extreme tail of a distribution, not the typical experience. Most auction transactions happen in the hundreds to low thousands, where careful attention to grading, scarcity, and comps matters more than hype.

Frequently Asked Questions

What is a buyer’s premium at a card auction?

A buyer’s premium is an additional percentage charged on top of the hammer price. At Heritage Auctions, it’s 20% with a $14 minimum per lot. So if you win a card at $500, you actually pay $600. Goldin’s buyer’s premium is negotiable and varies by consignment value. Always factor this into your maximum bid.

Is PSA grading worth the cost for every card?

No. With PSA’s February 2026 price increases, even the cheapest tiers run close to $30 per card. Grading only makes financial sense when the expected price difference between a raw card and a graded copy exceeds the grading cost by a comfortable margin. For common modern cards with high PSA 10 populations, grading often costs more than the premium it adds.

How do auction houses determine their pre-sale estimates?

They primarily use comparable sales data — what the same card in the same grade has sold for recently — combined with population report data showing how many graded copies exist. For unique items like 1-of-1 cards, estimates become more subjective and rely on the specialist’s experience with similar marquee lots.

What is the difference between an absolute auction and a minimum bid auction?

In an absolute (no reserve) auction, the card sells to the highest bidder regardless of price. In a minimum bid auction, the card won’t sell unless bidding reaches a set threshold. Absolute auctions tend to attract more bidders and generate competitive energy, but they carry real downside risk if the market is soft on sale day.

Do auction houses authenticate cards or just price them?

Major auction houses verify authenticity as part of the consignment process, but they rely heavily on third-party grading services like PSA, BGS, and SGC for formal authentication and grading. An ungraded card consigned to auction will typically be evaluated by the house’s specialists, but having a card already slabbed by a recognized grading service streamlines the process and builds buyer confidence.