Pokémon card values have been on a remarkable tear, with vintage cards climbing 30 to 50 percent over the past twelve months and certain sealed products doubling or tripling in value. While no single verified data source confirms an exact 25 percent surge in three months against tech stocks specifically, the broader trend is unmistakable: Card Ladder data reported by Fortune shows Pokémon cards are up 3,261 percent over twenty years, compared to the S&P 500’s 421 percent return over the same stretch. That is roughly an eightfold outperformance of the stock market, and the gap has only widened as the franchise approaches its 30th anniversary in February 2026. Consider the Surging Sparks booster box, which launched at a $140 MSRP and climbed to $250 to $300 by year-end, a gain of roughly 79 to 114 percent.

That kind of move in a single product would make any tech investor jealous. The average one-year return on a Pokémon card sits at approximately 46 percent, according to market tracking data, dwarfing the S&P 500’s average annual return of around 12 percent. But these numbers come with serious caveats that every collector needs to understand before treating their binder like a brokerage account. This article breaks down what is actually driving these price movements, which cards are appreciating and which are not, the role grading plays in value, the current market correction in early 2026, and how to think about Pokémon cards as part of a broader collecting strategy without getting burned.

Table of Contents

- Are Pokémon Card Values Really Outpacing Major Tech Stocks Right Now?

- Which Cards Are Actually Appreciating and Which Are Losing Value?

- The 30th Anniversary Effect and Why Vintage Prices Are Surging

- How to Evaluate Pokémon Cards as an Investment Compared to Traditional Assets

- The 2026 Market Correction and What It Means for Collectors

- Sealed Product as a Separate Asset Class

- Where the Pokémon Card Market Goes From Here

- Conclusion

- Frequently Asked Questions

Are Pokémon Card Values Really Outpacing Major Tech Stocks Right Now?

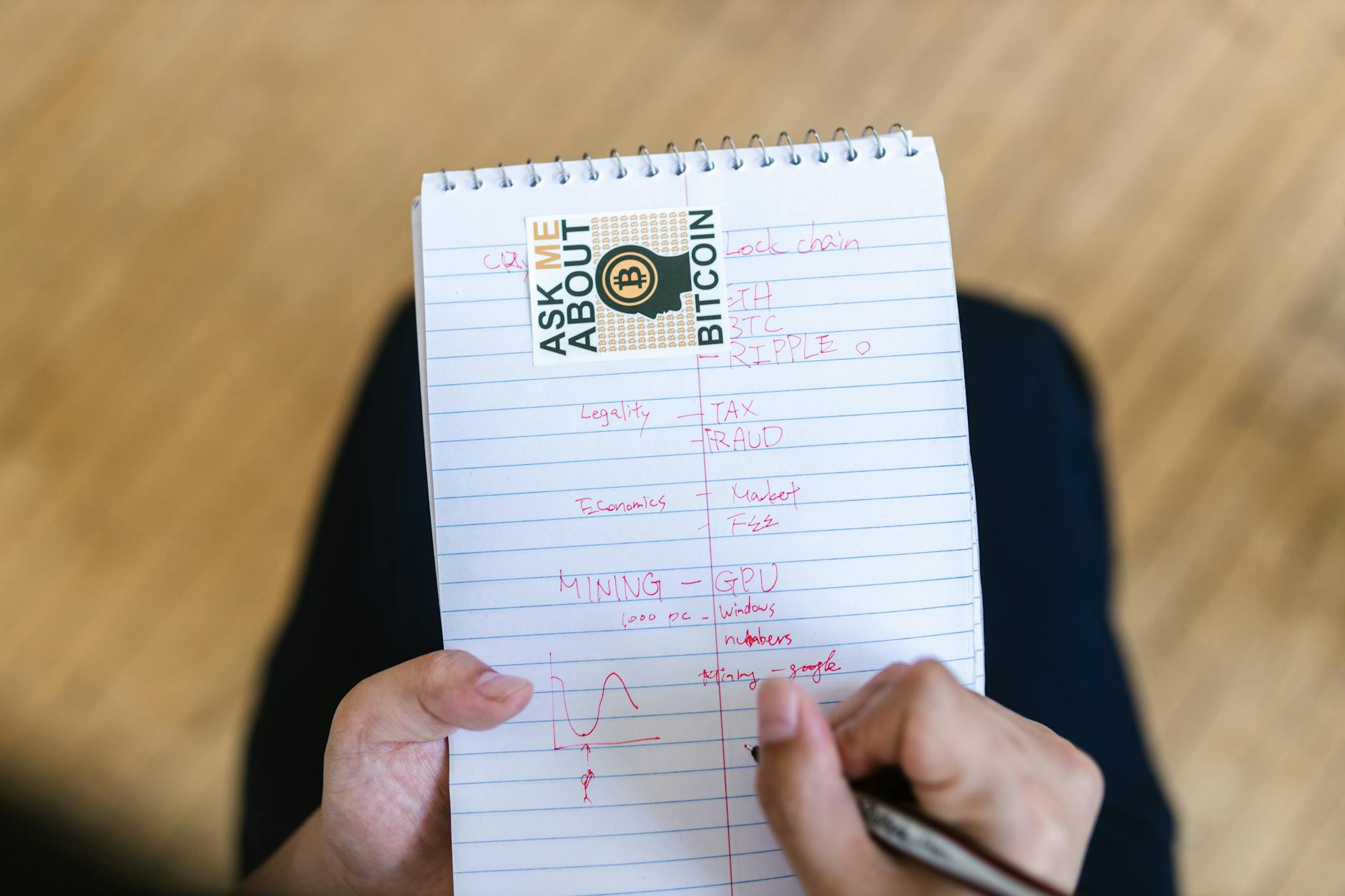

The headline numbers are real, but context matters enormously. Over a twenty-year horizon, pokémon cards have returned 3,261 percent versus the S&P 500’s 421 percent, a comparison first highlighted by Card Ladder and reported by Fortune and Yahoo Finance. On a one-year basis, the average Pokémon card return of 46 percent crushes the stock market’s roughly 12 percent annual average. These are not cherry-picked figures from a single rare card. They reflect broader market tracking across graded vintage cards and key modern sets. However, comparing cards to tech stocks over a short three-month window is trickier.

Vintage Pokémon cards saw 30 to 50 percent price increases in the twelve months leading into the franchise’s 30th anniversary, and certain products like Prismatic Evolutions sealed boxes from the Scarlet and Violet era appreciated 100 to 200 percent annually, driven largely by Eeveelution demand. These gains did outpace most individual tech stocks over comparable periods. But no verified index or tracking report pins down a precise 25 percent gain in exactly three months against a tech stock basket. What we can say is that the direction is correct: high-grade Pokémon cards have been moving faster than equities in recent quarters, and the data supporting that trend is substantial. The Surging Sparks pikachu ex Special Illustration Rare trading at approximately $271 is a good example. Cards like this do not sit at a price and wait. They move based on collector demand, PSA submission volume, and set availability in ways that make quarterly tech earnings look predictable by comparison.

Which Cards Are Actually Appreciating and Which Are Losing Value?

Not every pokémon card is a winning investment, and this is where the headline numbers can be deeply misleading. Only rare, high-grade cards appreciate meaningfully over time. Mass-produced modern cards from standard print runs often lose value the moment a new set drops. If you bought a common holo from a recent expansion expecting it to fund your retirement, you are likely sitting on a loss. The cards showing real strength right now fall into a few categories. Gengar cards have climbed steadily over the past twelve months as collectors continue to treat Gengar as a top-tier Generation I Pokémon with enduring cultural appeal.

Full-art Team Rocket cards saw noticeable demand increases around Christmas 2025, with sales volume holding through January 2026 according to TCGPlayer data. Even lower-tier first edition cards like Horsea from the Fossil set experienced speculative surges after viral collecting content drew attention to affordable vintage options. However, if you are buying into a card solely because it trended on social media, you should expect the price to cool once the attention fades. Speculative surges driven by content creators are not the same as sustained collector demand. PSA 10 graded cards are projected at a 15 to 25 percent compound annual growth rate through 2035, and they command a 2 to 5 times premium over raw ungraded copies of the same card. This premium exists because condition is everything in this market. A raw near-mint card and a PSA 10 gem mint copy can differ in price by hundreds or thousands of dollars, even though they look nearly identical to an untrained eye.

The 30th Anniversary Effect and Why Vintage Prices Are Surging

Pokémon’s 30th anniversary in February 2026 has been a major catalyst for vintage card prices. The 30 to 50 percent increases in vintage cards over the past year are not random. Anniversary milestones bring renewed media attention, nostalgia-driven buying from millennials and Gen Z collectors, and official Pokémon Company promotions that remind the broader public these cards exist and hold value. This pattern has played out before. The franchise’s 25th anniversary in 2021 coincided with a massive price spike, partly fueled by pandemic-era collecting and celebrity endorsements.

The current anniversary cycle is different in character but similar in outcome. Sealed product from the Scarlet and Violet era, particularly Prismatic Evolutions boxes, appreciated 100 to 200 percent annually because they hit at the intersection of anniversary hype and genuine product scarcity driven by Eeveelution popularity. For collectors who have been sitting on vintage cards, this window has been enormously profitable. A first edition Base Set Charizard in psa 10 condition is a generational asset at this point, and even mid-grade copies of popular vintage cards have benefited from the rising tide. The question is whether these prices hold once the anniversary buzz fades, and history suggests some correction is inevitable while the long-term trajectory for truly rare cards remains upward.

How to Evaluate Pokémon Cards as an Investment Compared to Traditional Assets

The most important thing to understand about Pokémon cards as investments is that they are physical, illiquid assets. Unlike stocks, you cannot sell a card with a tap on your phone and have cash in your account by the next business day. Selling takes time, condition matters enormously, and transaction costs through platforms like eBay or TCGPlayer eat into margins. A card is not like a share of Apple. You cannot split it, you cannot short it, and you cannot set a stop-loss on it. That said, the return data is hard to ignore.

A 3,261 percent return over twenty years versus 421 percent for the S&P 500 is an extraordinary gap. Even accounting for survivorship bias, where we are naturally drawn to the cards that did well rather than the thousands that did not, the top end of the Pokémon market has generated returns that most hedge funds would struggle to match. The tradeoff is that you need expertise, storage conditions, patience, and a willingness to accept that your asset could be damaged, lost, or stolen in ways that a stock in a brokerage account cannot. Grading is the great equalizer in this market. A PSA 10 slab provides authentication, condition verification, and a standardized measure that buyers trust. If you are thinking about cards as a serious alternative asset, grading your best cards is not optional. The 2 to 5 times premium that graded cards command over raw cards is effectively the market telling you that trust and verification have monetary value.

The 2026 Market Correction and What It Means for Collectors

Early 2026 has brought what market observers are calling a correction rather than a crash. The flip-for-profit model that thrived from 2020 through 2024, where people bought sealed product at retail and immediately resold it for a markup, has become unprofitable in 2026. Retailers and The Pokémon Company have caught up to demand with larger print runs for standard products, and the easy margins that attracted speculators have evaporated. This correction is actually healthy for the long-term market. When speculators exit, genuine collectors can acquire cards at more reasonable prices, and the market becomes less volatile.

But if you bought heavily into modern sealed product expecting quick flips, you are likely underwater on those positions. The lesson here is an old one: buying assets purely because the price went up last month is not a strategy. The cards that hold and gain value are the ones with genuine scarcity, strong character appeal, and high-grade conditions. It is also worth noting that correction does not mean the fundamentals have changed. Pokémon is the highest-grossing media franchise in history, the player base continues to grow, and the competitive TCG scene drives sustained demand for playable cards. What has changed is the easy-money dynamic, and collectors with a longer time horizon should view this correction as an opportunity rather than a warning sign.

Sealed Product as a Separate Asset Class

Sealed Pokémon product has emerged as its own category within the collectibles market, distinct from individual cards. Surging Sparks booster boxes rising from $140 MSRP to $250 to $300 illustrates how quickly sealed product can appreciate when a set contains chase cards that collectors want. Prismatic Evolutions sealed product appreciating 100 to 200 percent annually is an even more dramatic example, driven by the Eeveelution subset that has broad collector appeal.

The advantage of sealed product is that it preserves optionality. An unopened booster box contains the possibility of every card in the set, which can make it more valuable than any single card it might contain. The disadvantage is storage and the constant temptation to open it. If you are treating sealed product as an investment, you need climate-controlled storage and the discipline to leave the shrink wrap intact for years.

Where the Pokémon Card Market Goes From Here

Looking ahead, the data suggests that high-grade vintage Pokémon cards will continue to appreciate, though likely at a slower pace than the explosive gains of the past few years. PSA 10 cards projected at a 15 to 25 percent compound annual growth rate through 2035 represents strong but not outlandish growth, roughly in line with what premium collectibles across categories have delivered historically. The wildcard is new collector entry.

Gen Z and millennial men are driving much of the current demand according to Fortune’s reporting, and as this demographic enters peak earning years, their ability to spend on nostalgia-driven collectibles will only increase. The Pokémon franchise itself shows no signs of cultural decline. As long as new games, anime, and card sets keep the brand relevant to younger generations while nostalgia pulls in older collectors, the fundamental demand picture remains strong. The collectors who will do best are those who buy what they genuinely love, grade their best cards, and think in years rather than weeks.

Conclusion

The Pokémon card market has delivered returns that genuinely rival and often exceed traditional financial assets. A 3,261 percent twenty-year return, 46 percent average annual gains, and 30 to 50 percent vintage appreciation in the past year are numbers backed by real market data. Whether those gains hit exactly 25 percent in any given three-month window against tech stocks is less important than the undeniable trend: rare, high-grade Pokémon cards have been one of the best-performing alternative asset classes of the past two decades. But the market demands respect.

Cards are illiquid, condition-sensitive, and subject to speculative bubbles that punish latecomers. The 2026 correction is proof that not every card or strategy works. Focus on genuine rarity, get your best cards graded, store them properly, and resist the urge to chase whatever went viral last week. If you approach this market as a knowledgeable collector first and an investor second, the data suggests the long-term trend is firmly on your side.

Frequently Asked Questions

Have Pokémon cards really outperformed the S&P 500?

Yes. Card Ladder data shows Pokémon cards are up 3,261 percent over twenty years versus the S&P 500’s 421 percent, roughly an eightfold outperformance. The average one-year return on a Pokémon card is approximately 46 percent compared to the market’s 12 percent average.

Is now a good time to buy Pokémon cards as investments?

The early 2026 market correction has brought some prices down from speculative highs, which can benefit patient buyers. However, only rare and high-grade cards tend to appreciate meaningfully. Mass-produced modern cards often lose value, so selectivity matters more than timing.

How much does grading affect a Pokémon card’s value?

Significantly. PSA 10 graded cards command a 2 to 5 times premium over raw ungraded copies. Grading provides authentication and condition verification that buyers trust, and graded cards are projected at 15 to 25 percent compound annual growth through 2035.

What Pokémon cards are trending upward in 2026?

Gengar cards have climbed steadily over the past twelve months. Full-art Team Rocket cards saw demand increases around Christmas 2025 that held into January 2026. The Surging Sparks Pikachu ex Special Illustration Rare trades at approximately $271. Sealed Prismatic Evolutions product has appreciated 100 to 200 percent annually.

Are Pokémon cards a safe investment?

Cards are physical, illiquid assets with unique risks. They can be damaged, lost, or stolen. Selling takes time and platform fees reduce margins. The flip-for-profit model from 2020 to 2024 has become unprofitable in 2026. Cards should be considered an alternative asset class with high potential returns but also higher risk and lower liquidity than stocks.

Did Pokémon cards really surge 25 percent in three months?

While vintage cards have seen 30 to 50 percent increases over twelve months and certain products have appreciated even faster, no verified data source confirms an exact 25 percent gain in precisely three months compared to tech stocks. The broader trend of Pokémon cards outperforming equities is well documented, but the specific three-month figure should be treated as approximate.