Social media influencers have become one of the single most powerful forces driving Pokemon card prices, capable of sending values up by hundreds of percent overnight. The proof is in the numbers: when Logan Paul opened a 1st Edition Base Set Booster Box on camera in October 2020, StockX recorded a 300% increase in Pokemon card trades on its platform. A Charizard Base Set Unlimited PSA 9 that averaged $470 before Paul’s stream jumped to $4,366 in the month that followed — an 800% spike that, even after cooling off, settled at $2,284, still nearly four times the original price.

This is not a one-off anomaly. From Drake pulling a triple auto from a sports card box and triggering a 40% overnight spike in similar boxes, to competitive tournament results doubling card prices within 48 hours, the pattern is consistent: attention from high-profile figures translates directly into market movement. The broader trading card market hit $21.4 billion in 2024, with projections reaching $58.2 billion by 2034, and influencer activity is a significant engine behind that growth. This article breaks down exactly how these price spikes happen, who benefits, who gets burned, and how collectors can navigate a market increasingly shaped by viral moments.

Table of Contents

- How Do Social Media Influencers Actually Move Card Prices?

- The Logan Paul Effect and Why It Remains the Gold Standard

- Beyond Pokemon — How the Pattern Repeats Across All Cards

- How to Tell the Difference Between Hype and Real Demand

- The Dark Side of Influencer-Driven Markets

- How Competitive Results Compare to Influencer Spikes

- Where the Influencer-Card Market Relationship Is Heading

- Conclusion

- Frequently Asked Questions

How Do Social Media Influencers Actually Move Card Prices?

The mechanism is straightforward but brutal in its speed. When an influencer with millions of followers showcases a card — whether through a box break, a purchase announcement, or simply wearing one around their neck — they expose that card to an audience that dwarfs the traditional collector base. Most of these viewers are not seasoned hobbyists with established price knowledge. They are impulse buyers driven by excitement, and they hit the market all at once. When a PSA 10 Charizard is sitting comfortably at $2,500 and a celebrity purchases one on camera, listings immediately jump to $4,000. Flippers, who monitor influencer content specifically for these moments, flood eBay with the same card at double or triple the going rate.

The effect compounds because platforms like YouTube, TikTok, and Instagram reward content that generates engagement, and nothing generates engagement in the card world like big pulls and big price tags. Influencer-driven promotions have led to a 28% rise in trading card engagement on social media platforms. That engagement feeds the algorithm, which pushes the content to more viewers, which drives more buying, which drives prices higher. It is a feedback loop that traditional market forces — supply, condition, competitive play demand — simply cannot match in speed or scale. What makes this different from, say, a stock analyst recommending a company is that card markets have far less liquidity and far more emotional buyers. A single viral video can move a market that a Wall Street recommendation would barely dent in equities. The thin order books on platforms like eBay and TCGPlayer mean that a relatively small surge in demand can produce enormous price swings.

The Logan Paul Effect and Why It Remains the Gold Standard

No conversation about influencer impact on card prices is complete without dissecting what the hobby now calls “The Logan Paul Effect.” In October 2020, Paul purchased a sealed 1st Edition Base Set Booster Box for $200,000, which was a record at the time, and opened it on a livestream. That same box type later sold for $408,000 just three months later, in January 2021. The ripple effects touched nearly every corner of the vintage Pokemon market. Prices on cards that had been stable for years suddenly became volatile, and a generation of people who had not thought about Pokemon since childhood started searching for their old collections. The story did not end there. Paul acquired a PSA Grade 10 Pikachu Illustrator card in July 2021 by trading a PSA 9 Illustrator valued at $1.275 million plus $4 million in cash, and later sold it at a Goldin auction for $5.275 million. Then, just two days ago on February 16, 2026, that same Pikachu Illustrator card sold at Goldin Auctions for $16.49 million to buyer A.J.

Scaramucci — making it the most expensive trading card ever sold at auction, confirmed by Guinness World Records. Paul netted over $8 million in profit after fees. However, what many newer collectors miss is that the Logan Paul Effect was not uniformly positive for everyone. While it brought unprecedented attention and capital into the hobby, it also distorted price discovery for months. Collectors who bought during the peak of the hype often found themselves holding cards that corrected significantly downward. The Charizard Base Set Unlimited PSA 9 that spiked to $4,366 settled back to $2,284 — still elevated, but anyone who bought at the top lost nearly half their investment. The lesson is that influencer-driven spikes are real and powerful, but they are not the same thing as sustainable demand.

Beyond Pokemon — How the Pattern Repeats Across All Cards

The influencer effect is not limited to Pokemon. When Drake pulled a triple auto from a sports card box, similar boxes spiked 40% overnight. The sports trading card market specifically is projected to grow from $1.98 billion in 2025 to $6.1 billion by 2034 at a 13.3% compound annual growth rate, and celebrity involvement is accelerating that trajectory. Music and entertainment crossover cards featuring artists like Taylor Swift and Travis Scott are now attracting people who never previously collected cards of any kind, expanding the buyer pool in directions the hobby never anticipated. The Prismatic Evolutions Pokemon set, released in January 2025, offers a vivid example of how influencer hype can strain the entire supply chain. The set triggered such intense influencer-fueled buying that stores received only 10 to 15% of their requested inventory.

Content creators racing to post the first pulls and chase cards turned what should have been an exciting new release into a scarcity crisis. Collectors who simply wanted to open packs for fun found themselves unable to buy product at retail, forced to pay secondary market markups inflated by the very content they had been watching. This pattern — influencer hype, supply squeeze, secondary market inflation — has become almost predictable. It is worth noting that competitive play results create their own version of this cycle. Pokemon tournament results from Regional and World Championships increase card prices 30 to 50% within 24 to 48 hours, with World Championship results often doubling prices. The difference is that tournament-driven spikes are rooted in gameplay demand, which tends to be more durable than hype-driven demand.

How to Tell the Difference Between Hype and Real Demand

The practical challenge for collectors and investors is distinguishing between a price increase that reflects genuine, lasting demand and one that is purely influencer-fueled speculation. There are a few reliable indicators. Tournament-driven price increases tend to hold because they are based on competitive viability — players need the card, not just want to own it because they saw it on YouTube. A card that spikes because it won a Regional Championship has functional demand backing its new price. A card that spikes because an influencer called it “undervalued” in a thumbnail does not. Timing is another signal. Genuine demand-driven increases tend to build over days or weeks as information spreads through the competitive community.

Influencer-driven spikes happen in hours. If you see a card jump 40% or more in a single day and there is no tournament result or set rotation to explain it, the cause is almost certainly content-driven, and the correction is likely coming. The flippers who flood eBay with double and triple-priced listings after a celebrity post are not setting a new floor — they are testing a ceiling that usually does not hold. The tradeoff for collectors is real. If you wait to confirm whether a spike is sustainable, you risk missing a genuine price increase. If you buy immediately on influencer news, you risk being the person who bought the Charizard PSA 9 at $4,366 instead of $2,284. There is no clean answer here, but as a general principle, the more a price movement depends on a single person’s content rather than broad market fundamentals, the less likely it is to hold.

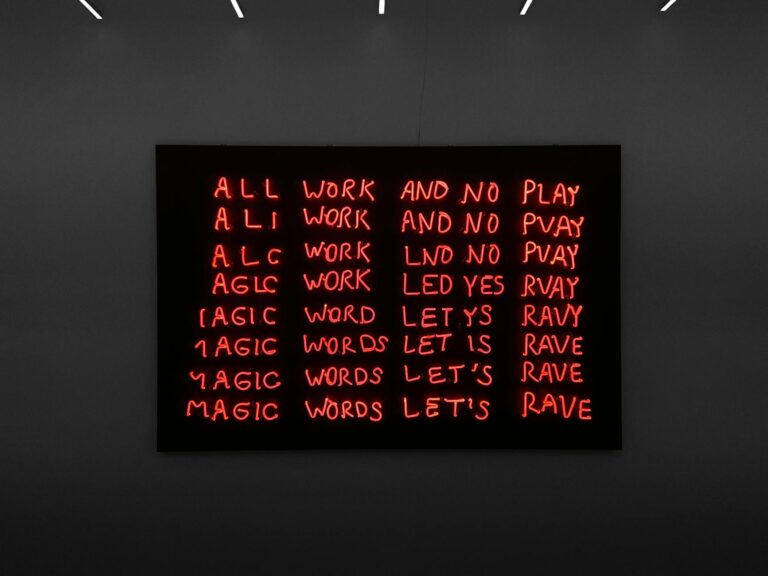

The Dark Side of Influencer-Driven Markets

Not all influencer involvement in the card market is organic enthusiasm. Some influencers are criticized for pumping up card values through paid promotions or exaggerated claims, creating unsustainable hype cycles. The structure of these promotions is not always transparent. An influencer might showcase a card they have already purchased in bulk, drive up demand through their content, and then sell into the spike they created. This is not hypothetical — it is a recurring complaint within the collecting community. The broader consequence is that influencer-driven price inflation has pushed prices out of reach for traditional collectors, creating what some observers describe as a bubble of FOMO-fueled spending.

Kids and longtime hobbyists who collected cards for the joy of the game increasingly find themselves priced out by speculators chasing the next viral moment. The Prismatic Evolutions supply crisis is a perfect example: a set designed for players and collectors became a speculative commodity before most of its target audience could even find it on shelves. There is also the question of market stability. A market driven by influencer attention is inherently volatile because influencer attention is inherently fickle. When content creators move on to the next trend — and they always do — the demand they brought evaporates with them. Collectors who built their purchasing decisions around influencer sentiment rather than personal enjoyment or competitive need often find themselves holding inventory that nobody wants once the cameras stop rolling.

How Competitive Results Compare to Influencer Spikes

Tournament results offer an instructive contrast to influencer-driven price movements. When a card performs well at a Regional or World Championship, its price increase is rooted in demonstrated competitive value. Pokemon tournament results consistently push prices up 30 to 50% within 24 to 48 hours, and World Championship results can double prices. These spikes tend to be more durable because the underlying demand — players who need the card to compete — persists as long as the card remains competitively relevant. Influencer spikes, by contrast, are driven by attention rather than utility.

The attention dissipates as soon as the next piece of content goes up. This does not mean influencer-driven increases always crash back to zero — the Logan Paul Effect permanently elevated baseline prices for vintage Pokemon cards by bringing new capital into the hobby. But the trajectory is different. Tournament spikes tend to plateau and hold. Influencer spikes tend to peak sharply and then correct, sometimes settling above the original price and sometimes not.

Where the Influencer-Card Market Relationship Is Heading

The intersection of social media and trading cards is not slowing down. With the broader trading card market projected to reach $58.2 billion by 2034, and influencer marketing becoming more sophisticated every year, the relationship between content creators and card prices will only deepen. The $16.49 million sale of the Pikachu Illustrator card on February 16, 2026, is not an endpoint — it is a signal that the ceiling for marquee cards has not been found yet, and that influencer involvement continues to push it higher.

What collectors should expect is more volatility, not less. As entertainment and music crossover cards bring in buyers from outside the traditional hobby, and as influencers continue to discover that card content drives massive engagement, the feedback loop between social media attention and card prices will intensify. The collectors who fare best in this environment will be the ones who understand the difference between a card’s intrinsic value — its rarity, condition, competitive relevance, and cultural significance — and its hype value, which is real but temporary. Building a collection around the former while being aware of the latter is the most reliable strategy in a market that can move 800% on a single livestream.

Conclusion

Social media influencers have fundamentally altered how Pokemon card prices are set. The data is unambiguous: Logan Paul’s involvement drove an 800% spike in Charizard PSA 9 prices, a 300% increase in platform trading volume, and culminated in a $16.49 million record sale just days ago. Celebrity pulls cause overnight price jumps of 40% or more, and influencer-fueled hype can strain supply chains so severely that stores receive a fraction of their requested inventory. These are not subtle effects — they are market-defining forces. For collectors, the path forward requires a clear-eyed understanding of what influencers can and cannot do to card values.

They can create dramatic short-term spikes, bring new buyers into the hobby, and permanently elevate baseline prices for iconic cards. What they cannot do is create sustainable value where none exists. Cards with genuine rarity, historical significance, and competitive relevance will hold their value regardless of who is filming them. Cards that are only valuable because someone famous held them up to a camera are a bet on continued attention — and attention, by its nature, moves on. Know the difference, and you will navigate this market far better than most.

Frequently Asked Questions

How quickly do card prices react to influencer content?

Extremely quickly. Celebrity pulls and purchases can cause 40% or more price spikes overnight. Flippers monitor influencer content in real time and immediately list cards at double or triple the going rate on platforms like eBay.

Did the Logan Paul Effect permanently raise Pokemon card prices?

Partially. While the initial 800% spike on Charizard Base Set Unlimited PSA 9 corrected significantly, the price settled at $2,284 — still a 386% increase over the pre-Paul average of $470. Baseline prices for vintage Pokemon cards were permanently elevated by the new capital and attention Paul brought into the hobby.

How is influencer-driven demand different from tournament-driven demand?

Tournament results cause price increases of 30 to 50% that tend to hold because they reflect competitive need — players actually require those cards to compete. Influencer-driven spikes are based on attention, which is temporary by nature, so they tend to peak sharply and then correct.

Are influencers manipulating card prices?

Some are criticized for pumping up card values through paid promotions or exaggerated claims, sometimes buying cards in bulk before promoting them and selling into the resulting spike. The lack of transparency around these promotions is an ongoing concern in the collecting community.

How much has the trading card market grown?

The broader trading card market hit $21.4 billion in 2024, with projections of $58.2 billion by 2034. The sports trading card segment specifically is projected to grow from $1.98 billion in 2025 to $6.1 billion by 2034 at a 13.3% CAGR.

Should I buy cards immediately when an influencer features them?

Generally, no. Influencer-driven spikes often correct significantly after the initial hype fades. If a card jumps 40% or more in a single day without a tournament result or set rotation to explain it, the cause is likely content-driven and the price may not hold. Waiting for the correction is usually the safer strategy, though you risk missing gains if the increase turns out to be durable.